For today’s post, we turned to Taylor Hayes, a Mortgage Agent with Today’s Mortgage Choice to learn more about why it’s better to “marry the house and date the rate.” Keep reading to find out why Taylor recommends buying a home before interest rates go down.

Are you one of the thousands of Canadians looking to enter the housing market, but are waiting for the Bank of Canada to lower their benchmark interest rate? If so, you aren’t alone as the dynamics between interest rates and home prices play a significant role in shaping the decisions of buyers. Interest rates were historically low for several years, and home prices only seemed to appreciate. But now, interest rates have risen significantly and appreciation has slowed in most markets. So is now the right time to buy?

There is a term we mortgage brokers like to use, called “marry the house and date the rate”. At the end of the day, you are not married to your interest rate, but the price you pay for your house is locked in forever. It’s well known that Canada is in a housing crisis and that we do not have enough supply to keep up with demand. If the Bank of Canada starts to lower it’s interest rate around June/July, there is likely going to be a flood of buyers rushing to enter the housing market and they are going to find themselves in multiple offers and bidding wars, pushing up home prices and reducing overall affordability. A Desjardins report from earlier this year claimed that lower interest rates are expected to bring prospective homebuyers off the sidelines, resulting in a broad-based rebound in home prices in the second half of 2024 that will spill over into 2025. If the above occurs, home buyers will be in a much better position if they purchase now while home prices are lower, obtain a shorter mortgage term, and renew once interest rates are lower.

Do you have more real estate questions? Read our post “Debunking 5 Market Misconceptions” right here.

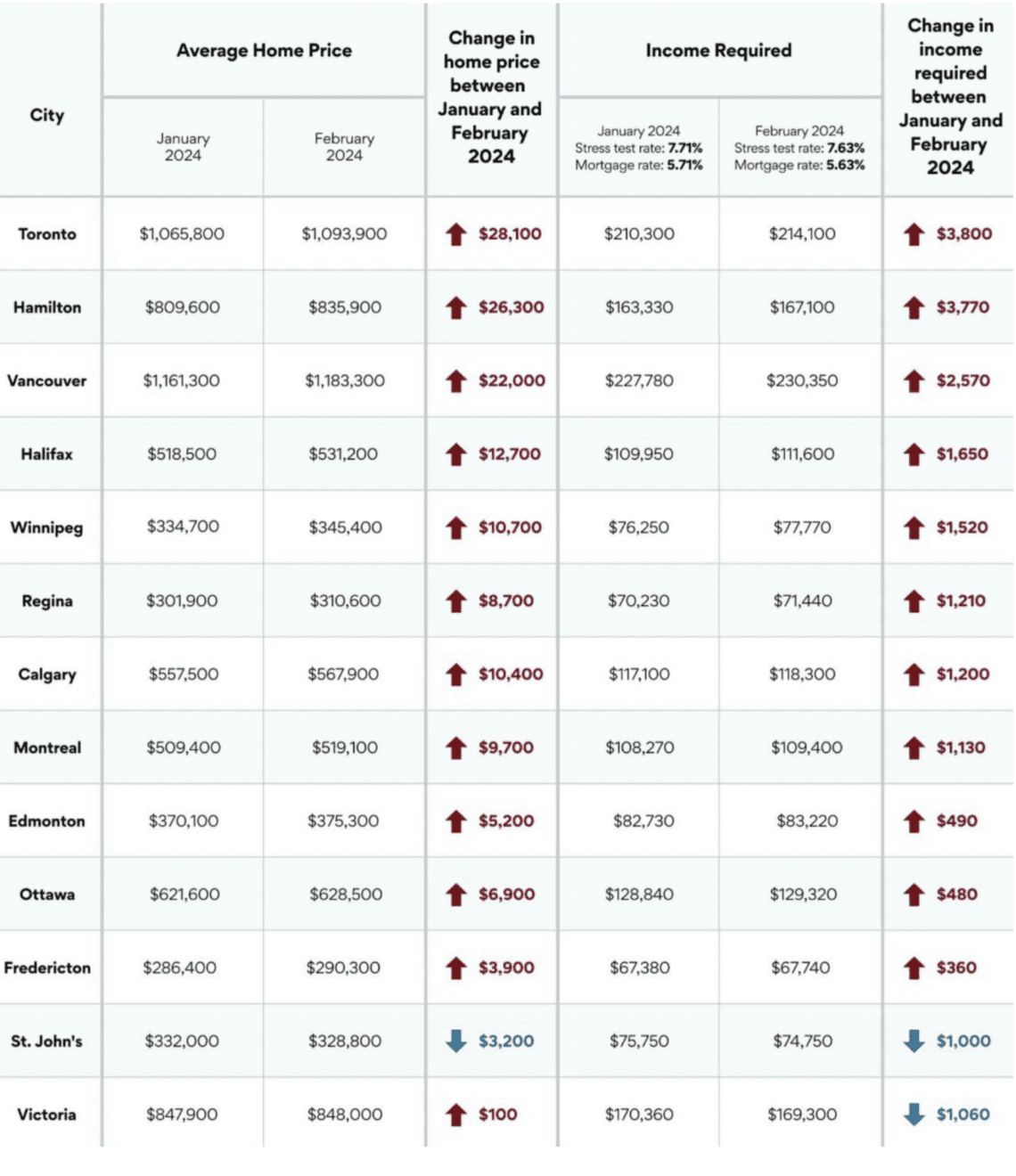

According to an analysis conducted by ratehub.ca the minimum income required to purchase an average-priced home increased in 11/13 markets examined between January and February 2024. The largest increase in the minimum income required was in Toronto where buyers need to earn an additional $3,800 annually as the average home price increased by $28,100 in a single month ($1,065,800 -> $1,093,900).

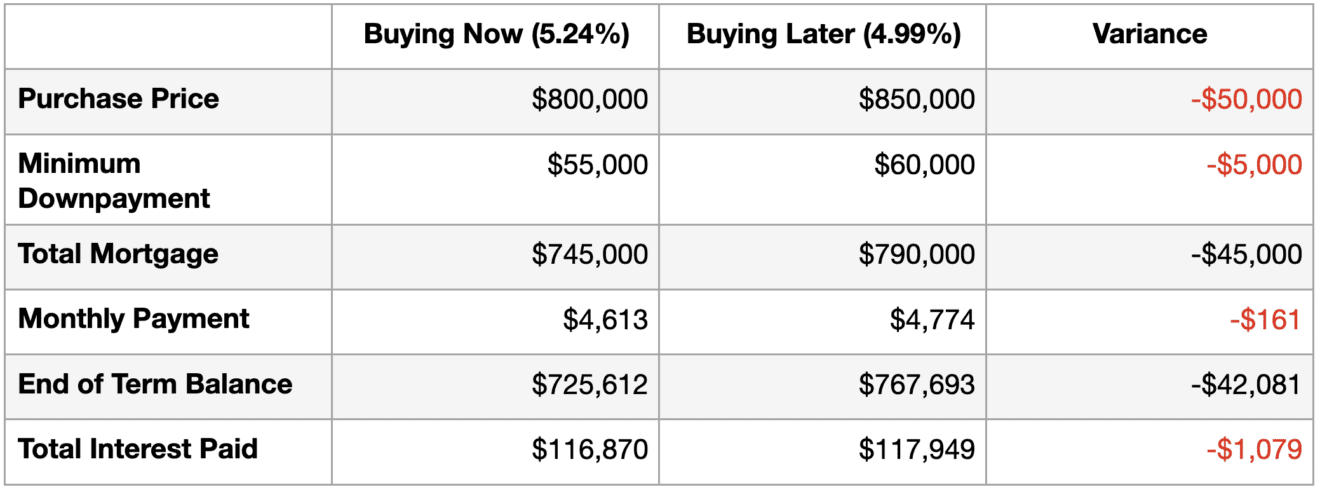

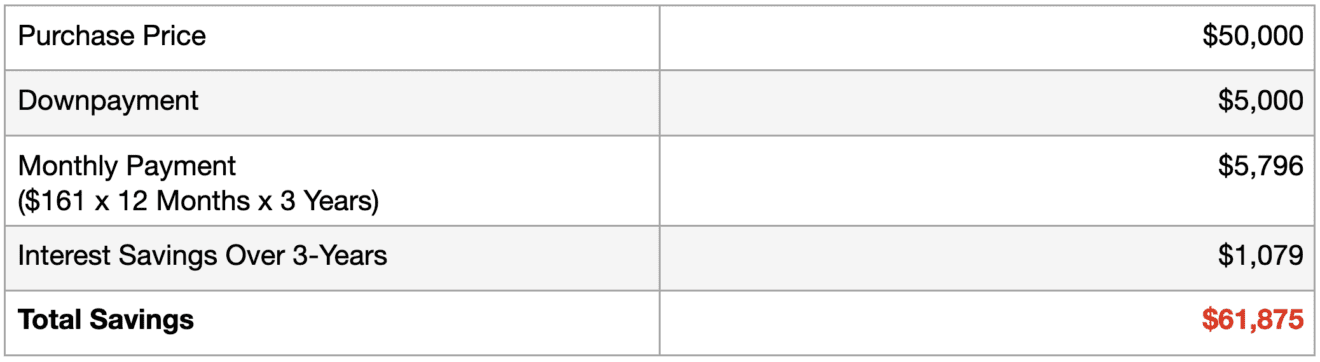

The expected increase in home sales and prices is broadly based on the belief that the Bank of Canada will be reducing its benchmark interest rate in the near future. But, what is going to happen to home prices once the Bank of Canada actually reduces its benchmark interest rate? Well, let’s take a look at an example and compare buying a more affordable home and paying higher interest (5.24%) vs. waiting a couple of months to secure a lower interest rate (4.99%) and paying a premium for the purchase of your home due to multiple offers and bidding wars.

Comparison: 3-Year Term, 25-Year Amortization

Savings

Despite the potential short-term financial gains let’s explore some additional benefits and considerations when purchasing in an environment where interest rates are higher and home prices are lower:

- Less Competition: In markets where home prices are declining, there may be fewer buyers competing for properties. This can create opportunities for buyers to negotiate better deals, including lower purchase prices, favorable terms, or concessions from sellers. Additionally, with less competition, buyers may have more time to conduct thorough due diligence and make informed decisions without feeling rushed.

- Potential for Future Appreciation: Buying when home prices are lower positions buyers to benefit from potential future appreciation. As the market rebounds and home values increase over time, buyers who purchased at a lower price point stand to gain significant equity in their properties. This can be particularly advantageous when purchasing your primary residence or making long-term investments in real estate.

- Greater Purchasing Power: Despite higher interest rates, lower home prices can translate into increased purchasing power for buyers. This means that even though your monthly mortgage payments may be higher due to currently elevated interest rates, you may still be able to afford a more substantial or better-located property than you would have in a market with higher home prices.

I think it’s also important to remind prospective buyers that the Bank of Canada announcements do not influence fixed mortgage rates, instead they have a direct impact on variable mortgage rates and Home Equity Lines of Credit (HELOC). Whereas, fixed mortgage rates are primarily influenced by the Government of Canada’s 5-year bond yields.

Anyone who is sitting on the sidelines waiting for the Bank of Canada to lower interest rates before they enter the housing market, I urge you to reconsider. Don’t wait until the market frenzy, get in touch today to become pre-approved!

Do you have questions about mortgage rates? You can get in contact with Taylor directly right here:

- Taylor Hayes, Mortgage Agent

- 416-617-3956

- thayes@tmcgroup.ca

- Today’s Mortgage Choice LIC #13324

For more real estate answers, get in contact with Willows Realty Group directly by emailing us at team@willowsgroup.ca or calling 1.888.926.2066 today!

Stay connected to the market.

Sign up to our digital newsletter community.